General

Synopsis

Indian stock markets faced a downturn due to Donald Trump’s tariffs and concerns over additional tariffs on Indian goods, leading to losses in key indices. Investors are hopeful that the upcoming GST Council meeting and potential tax slab reforms will boost domestic consumption and revive market sentiment.

Donald Trump’s tariff offensive against India knocked the domestic stock market off balance, with key share indices notching up losses in a shortened trading week. Investors are now pinning hopes on the proposed goods and services tax (GST) rationalisation likely in the week ahead to alleviate concerns over the fallout from the 50% tariffs imposed by the US on Indian goods.

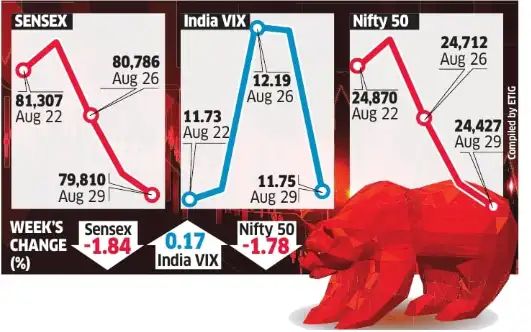

On Friday, the NSE Nifty fell 74 points or 0.3% to close at 24,426.85. The BSE Sensex declined 271 points or 0.34% to end at 79,809.65. Both indices have fallen 1.8% in the four-day trading week. The markets were shut Wednesday for Ganesh Chaturthi.

“The tariff overhang has been weighing on the domestic markets, due to which we have seen another week of decline in the benchmark and broader market indices,” said Amit Khurana, head of equities at Dolat Capital Market. “Market sentiment remains weak because of lack of fresh buying interest.”

An additional 25% tariff on Indian goods effect August 27, due to India’s purchases of oil from Russia, on top of the 25% already in place. The uncertainty over the impact of the move on the Indian economy is weighing down sentiment.

All eyes are now on the GST Council meeting scheduled for September 3-4, when the tax slab reform is expected to be approved in a move seen boosting domestic consumption. Sectors such as auto, cement, consumer, retail, hotels and financial services will be the likely beneficiaries of GST 2.0, experts said.

ETMarkets.com

ETMarkets.com

General Technical Support Area

That could result in a technical pullback in the market from current oversold levels. “Both Nifty and Bank Nifty are now in oversold territory, suggesting that any positive trigger could lead to short covering and a potential rebound,” said Dharmesh Shah, head of technicals at ICICI Securities.

The Nifty Bank index has declined 2.7% this week. Shah said the Nifty is holding just above its key support zone of 24,000-24,200, which aligns with the 200-day moving average, and a strong technical support area. The Nifty Volatility Index or VIX fell 3.5% to 11.75 on Friday, mirroring the market’s gentler decline after two days of a near 1% fall.

Broader indices also lost ground on Friday-the Nifty Midcap 150 dropped 0.6% and the Nifty Small-cap 250 fell 0.3%. They have each ended nearly 3.2% lower this week. Of the total 4,237 stocks traded on the BSE, 1,777 advanced and 2,317 declined at close. On Friday, foreign portfolio investors net sold shares worth ₹8,313 crore.

Domestic institutions were buyers to the tune of ₹11,488 crore. According to BSE’s provisional numbers, FPIs offloaded shares worth ₹46,903 crore and DIIs bought shares worth ₹94,829 crore in August.

(What’s moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

…moreless

(You can now subscribe to our ETMarkets WhatsApp channel)

(What’s moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

…moreless