Synopsis

HUL’s sales volume saw a strong recovery in the December quarter. The company anticipates a better second half of the fiscal year and improved performance next year. This optimism stems from strategic portfolio changes and a positive economic outlook. Acquisitions like Minimalist are boosting growth in premium segments.

Listen to this article in summarized format

ET Intelligence Group: HUL‘s year-on-year sales volume growth recovered to a multi-quarter high of 4% in the December quarter after staying flat in the prior quarter, reflecting traction across major business segments.

However, it reported 70 basis point contraction in operating margin before depreciation and amortisation (Ebitda margin) at 23.3% driven by labour code related charges; the margin still remained above the company’s guidance band of 22-23% indicating lack of any stress from operating costs such as raw material prices and inventory management.

The FMCG major expects second half of the current fiscal year ending in March 2026 to be better than the first half and to report even better numbers next year. Its optimism is driven by progress in portfolio and channel transformation, and better macroeconomic scenario including improved consumer sentiments and better consumption demand in rural regions and improving urban traction.

Agencies

Agenciesgame is on Co is betting on rebound in rural & urban consumption and portfolio transformation

The company’s shares fell 2% on Thursday after it reported a 30% YoY decline in net profit for the December quarter, largely on account of a one-off impact from labour code provisions. Excluding this and one-time gain from sales of the ice cream division, net profit grew by a modest 1%.

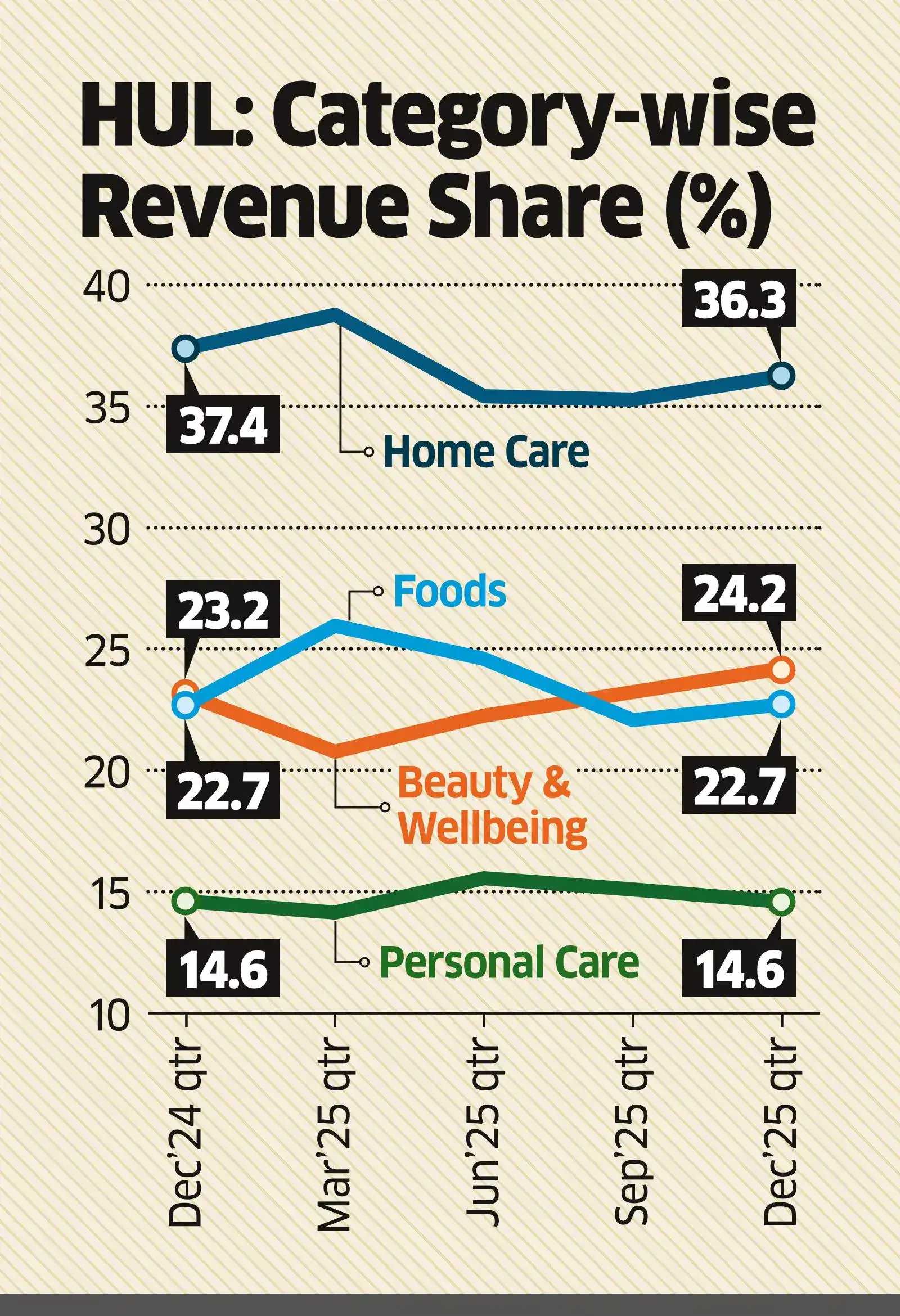

HUL’s inorganic growth strategy to expand in new consumer segments is paying off. The acquisition of Minimalist in January last year has helped the company to gain traction in the premium skincare space. The brand has grown faster under HUL. Its sales are not disclosed separately but is included in the beauty & wellbeing division. This division’s revenue grew fastest among all categories, rising 11% year-on-year and 5.3% sequentially. This segment’s share in total revenue has gradually increased to 24.2% in the December 2025 quarter from 20.8% in March 2025.

HUL’s decision to buy the remaining 49% stake in Zywie Ventures (Oziva), appears to be a part of the same strategy to drive long-term growth.

(What’s moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

…moreless

(You can now subscribe to our ETMarkets WhatsApp channel)

(What’s moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

…moreless