New Delhi: Revenue growth in India’s telecom industry slowed to a single digit after five quarters of double-digit expansion despite strong subscriber additions and increasing data usage in the October-December period, as benefits of tariff hikes which happened in July 2024 have now been fully baked in.

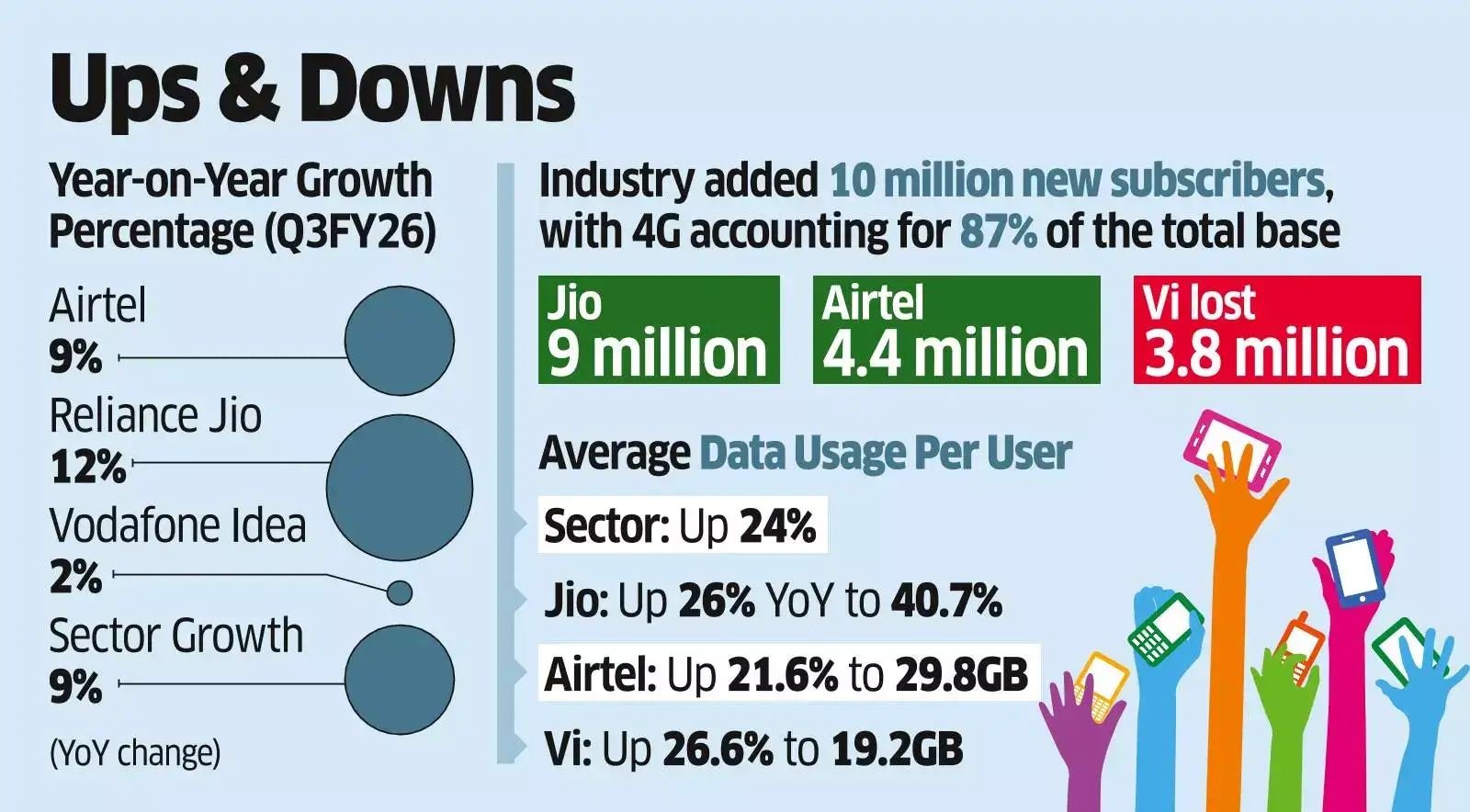

The combined India telecom revenue of the three private telecom operators-Reliance Jio, Bharti Airtel and Vodafone Idea-grew 9% from a year earlier to around ₹72,700 crore in the December quarter, which analysts said was the slowest since September 2024. This even as they added around 10 million net subscribers, with 4G connections now accounting for 87% of the base.

ET Bureau

ET BureauAverage data usage per subscriber for the three private telcos saw an outsized surge compared with a year before. For most of FY26, the year-over-year growth in data usage was hovering in the 20% range. In the third quarter, this surged to 24% to 29.9 GB per user. For market leader Reliance Jio, which operates a fully internet protocol-based network, data usage jumped 26% to 40.7 GB per user.

The acceleration in data usage was driven mainly by 5G adoption with unlimited data offerings and a sharp rise in content consumption and connected devices, contributing to revenue growth but at a slower pace.

According to brokerage CLSA, the flow through of tariff hikes has been the highest for Bharti Airtel with a 23% increase in average revenue per user (ARPU), compared with 18% for Jio and 17% for Vodafone Idea. Airtel’s ARPU was Rs 259 in Q3, which was 21% higher than that of Jio.

In the absence of tariff hikes, the industry is expected to continue pushing ARPU, a key performance metric, through subscriber premiumisation wherein customers are enticed with bundled offerings to upgrade to higher plans, analysts said. They expect the next round of tariff hikes to likely happen in the second half of this fiscal year.

Brokerage Jeffries assumes a 15% tariff hike to happen in FY27 and another 10% in FY28, while Kotak Equities expect hikes to range around 12% in next fiscal year. Goldman Sachs sees the growth moderation in the past quarter as a timing issue from the delay in tariff hikes.