Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD drops below 1.1750 on modest USD rebound

EUR/USD stays under modest bearish pressure and trades below 1.1750 in the second half of the day on Friday. The US Dollar (USD) holds its ground on growing optimism about improving US-China relations, making it difficult for the pair to gain traction.

GBP/USD drops to 1.3450 area after weak UK Retail Sales data

GBP/USD continues to push lower after closing in negative territory on Thursday and trades near 1.3450 on Friday. Weaker-than-expected Retail Sales data from the UK and the broad-based US Dollar strength forces the pair to stay on the back foot heading into the weekend.

Gold drops to fresh weekly low below $3,350

Gold stays under bearish pressure for the third consecutive day and trades at a fresh weekly low below $3,350. Improving risk mood on news of the US and China organizing the next round of talks for next week and rising US T-bond yields weigh on XAU/USD.

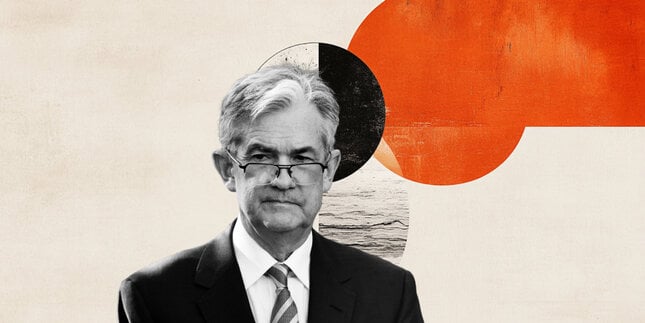

Is the Fed behind the curve?

Fed is under increasing scrutiny about its decision to delay rate cuts. Ongoing tariff uncertainty and resilient economy support Fed’s case for pause. But Fed may have left it too late amid some cracks in labour market.

Best Brokers for EUR/USD Trading

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you’re a beginner or an expert, find the right partner to navigate the dynamic Forex market.